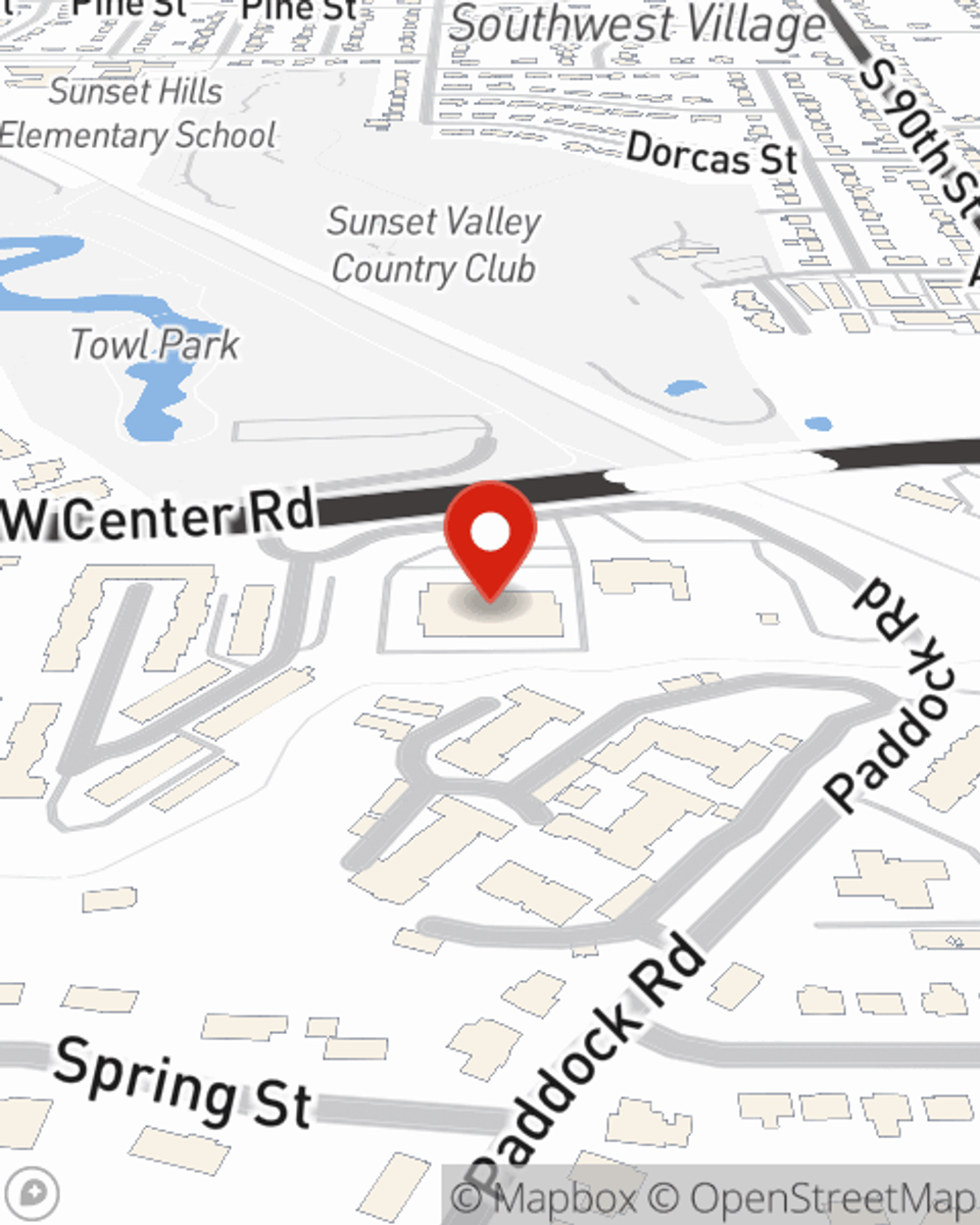

Business Insurance in and around Omaha

Looking for small business insurance coverage?

No funny business here

State Farm Understands Small Businesses.

Running a small business comes with a unique set of challenges. You shouldn't have to work through those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, errors and omissions liability and business continuity plans, among others.

Looking for small business insurance coverage?

No funny business here

Keep Your Business Secure

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Shawn Benge for a policy that safeguards your business. Your coverage can include everything from business continuity plans or extra liability coverage to employment practices liability insurance or key employee insurance.

Agent Shawn Benge is here to discuss your business insurance options with you. Visit with Shawn Benge today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Shawn Benge

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.